Weigh and Select Medicare Advantage Plans: Lower Hundreds of dollars on Insurance while you Take Action Today

Getting familiar with Medicare Advantage Plans

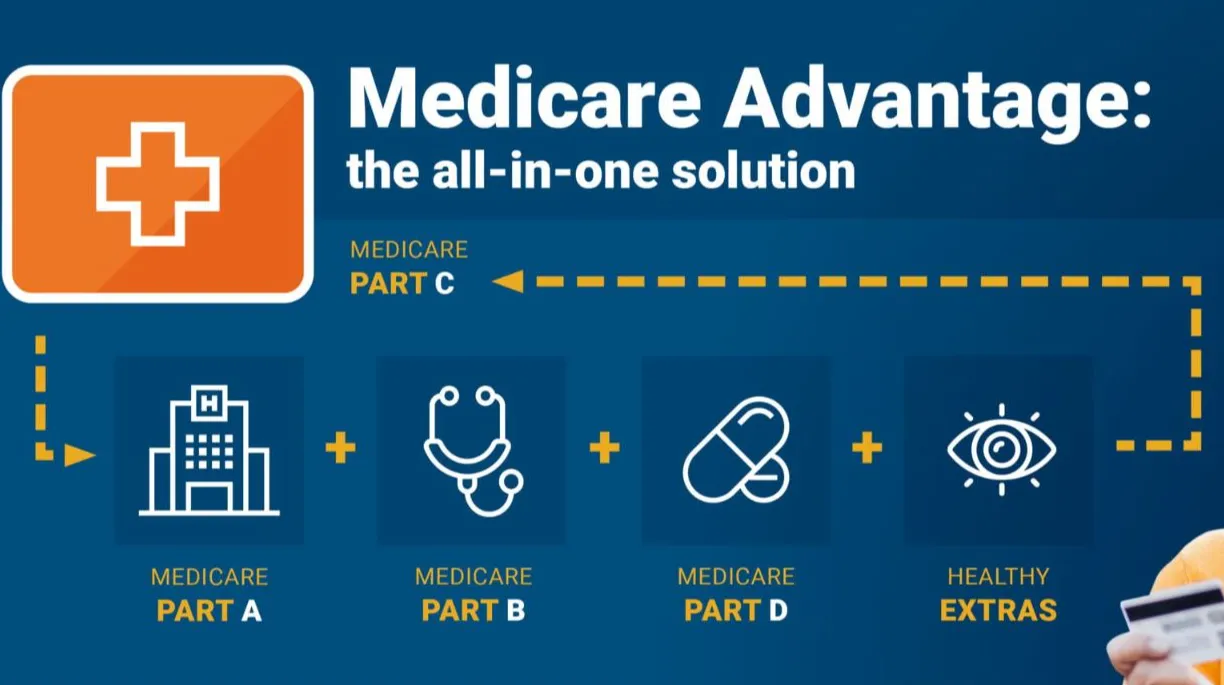

Medicare Advantage Plans represent offered by non-government Insurance carriers that work alongside Medicare to deliver Part A and Part B benefits in a single integrated structure. Unlike traditional Medicare, Medicare Advantage Plans often include extra benefits such as prescription coverage, oral health care, eye care services, with wellness programs. These Medicare Advantage Plans operate within established coverage regions, so residency a important element during evaluation.

How Medicare Advantage Plans Compare From Traditional Medicare

Traditional Medicare offers broad medical professional availability, while Medicare Advantage Plans generally operate through organized provider networks like HMOs with PPOs. Medicare Advantage Plans can include provider referrals along with network-based doctors, but they frequently offset those restrictions with consistent out-of-pocket amounts. For countless enrollees, Medicare Advantage Plans deliver a middle ground between cost control along with enhanced services that Traditional Medicare by itself does not deliver.

Who May want to Evaluate Medicare Advantage Plans

Medicare Advantage Plans are well suited for individuals interested in managed care as well as expected financial savings under a single plan structure. Older adults managing ongoing health conditions often prefer Medicare Advantage Plans because coordinated treatment structures simplify treatment. Medicare Advantage Plans can further attract enrollees who want combined services without maintaining separate secondary coverages.

Qualification Criteria for Medicare Advantage Plans

To enroll in Medicare Advantage Plans, participation in Medicare Part A also Part B required. Medicare Advantage Plans are open to most people aged sixty-five and also older, as well as younger individuals with qualifying disabilities. Enrollment in Medicare Advantage Plans is based on residence within a plan’s coverage region plus enrollment timing aligned with permitted registration timeframes.

When to Sign up for Medicare Advantage Plans

Proper timing plays a critical part when selecting Medicare Advantage Plans. The First-time sign-up window surrounds your Medicare qualification milestone & permits first-time selection of Medicare Advantage Plans. Skipping this period does not necessarily eliminate access, but it does change available options for Medicare Advantage Plans later in the year.

Annual not to mention Special Enrollment Periods

Every fall, the Annual enrollment window gives individuals to change, remove, or add Medicare Advantage Plans. Qualifying enrollment windows are triggered when qualifying events happen, such as relocation alternatively coverage termination, allowing changes to Medicare Advantage Plans outside the normal schedule. Understanding these periods supports Medicare Advantage Plans remain available when situations shift.

Ways to Review Medicare Advantage Plans Effectively

Evaluating Medicare Advantage Plans demands care to beyond recurring costs alone. Medicare Advantage Plans differ by network structures, out-of-pocket maximums, drug lists, as well as benefit conditions. A thorough review of Medicare Advantage Plans assists matching healthcare needs with coverage structures.

Expenses, Coverage, in addition to Provider Networks

Monthly expenses, copays, plus annual maximums all define the overall value of Medicare Advantage Plans. Some Medicare Advantage Plans feature low monthly costs but elevated out-of-pocket expenses, while alternative options emphasize consistent expenses. Provider availability also differs, making it essential to confirm that chosen providers accept the Medicare Advantage Plans under consideration.

Prescription Coverage & Additional Benefits

A large number of Medicare Advantage Plans include Part D prescription benefits, easing medication management. In addition to medications, Medicare Advantage Plans may offer fitness programs, transportation services, and over-the-counter allowances. Reviewing these extras helps ensure Medicare Advantage Plans align with daily medical needs.

Joining Medicare Advantage Plans

Enrollment in Medicare Advantage Plans can occur online, by phone, and also through authorized Insurance Agents. Medicare Advantage Plans need precise individual details as well as confirmation of eligibility before coverage activation. Finalizing enrollment carefully avoids processing delays plus unplanned coverage gaps within Medicare Advantage Plans.

The Importance of Authorized Insurance Agents

Authorized Insurance Agents support explain plan details with explain differences among Medicare Advantage Plans. Connecting with an expert can resolve network restrictions, benefit limits, plus expenses linked to Medicare Advantage Plans. Professional guidance commonly accelerates the selection process during sign-up.

Frequent Errors to Watch for With Medicare Advantage Plans

Missing doctor networks ranks among the frequent issues when evaluating Medicare Advantage Plans. A separate challenge involves focusing only on monthly costs without reviewing total expenses across Medicare Advantage Plans. Examining plan materials carefully helps prevent confusion after sign-up.

Reassessing Medicare Advantage Plans Each Year

Healthcare priorities change, plus Medicare Advantage Plans adjust every year as well. Reviewing Medicare Advantage Plans during open enrollment periods allows adjustments when coverage, expenses, in addition to providers change. Consistent assessment keeps Medicare Advantage Plans consistent with existing healthcare priorities.

Reasons Medicare Advantage Plans Continue to Grow

Participation patterns demonstrate growing engagement in Medicare Advantage Plans nationwide. Additional coverage options, Policy National Medicare Advantage Plan options predictable spending caps, not to mention coordinated care help explain the growth of Medicare Advantage Plans. As options increase, well-researched review becomes increasingly essential.

Long-Term Value of Medicare Advantage Plans

For numerous enrollees, Medicare Advantage Plans deliver stability through integrated coverage also structured healthcare. Medicare Advantage Plans can lower management complexity while supporting preventive care. Selecting appropriate Medicare Advantage Plans creates confidence throughout later life years.

Compare and also Choose Medicare Advantage Plans Today

Taking the right step with Medicare Advantage Plans opens by exploring available choices plus checking eligibility. If you are currently new to Medicare and/or reviewing existing coverage, Medicare Advantage Plans offer adaptable coverage options created to support different healthcare needs. Compare Medicare Advantage Plans now to identify a plan that fits both your medical needs as well as your budget.